Questions about the fresh FHA system requirements or pre-approval? So you can expedite their demand quickly, delight fill in the fresh quick suggestions consult form in this post, all week long.

If you are searching so you can re-finance another kind of mortgage loans such as Va, USDA, or Antique, excite submit the data Demand Mode for additional information on refinancing solutions.

In this post

- What’s an enthusiastic FHA refinance mortgage?

- Why apply for good FHA re-finance?

- How come a keen FHA refinance loan works?

- Who qualifies for FHA re-finance?

- Kind of FHA refinances money

- FHA Cash-out Refinance

- FHA (Government Casing Administration) Streamline Refinance

What is actually a keen FHA home mortgage refinance loan?

The brand new FHA mortgage program might have been very popular than ever before the last few years as borrowing happens to be much harder discover. FHA money are among the ideal solutions getting individuals that would want to refinance the financial to track down a better contract or to pay-off financial obligation. FHA fund have been called a simple mortgage to help you qualify due into versatile borrowing from the bank direction additionally the low equity conditions. Taking FHA loans try prominent to own homebuyers have been thanks to a financial credit experience such as for example an initial deals, property foreclosure or any other pecuniary hardship across the life of the mortgage prior to now and tend to be trying to get its funds back focused.

Why apply for good FHA refinance?

FHA refinance software are designed to help individuals which have existing FHA financing straight down the month-to-month mortgage payments otherwise access security within their residential property. Listed below are some reason why you can believe making an application for a keen FHA refinance:

Down Rates: Among the first reasons to re-finance an FHA loan is to take benefit of all the way down interest rates. In the event the market rates has dropped because you initial obtained their FHA loan, refinancing can help you safer a different mortgage that have a diminished interest, potentially cutting your monthly payments.

Faster Monthly premiums: By the refinancing your FHA loan, you will be capable increase the mortgage identity, ultimately causing lower monthly mortgage repayments. That is particularly of good use if you are against financial demands otherwise have to replace your income.

Convert away from Changeable Speed to Repaired Rates: For those who have an FHA changeable-speed home loan (ARM) consequently they are concerned with ascending rates of interest, you could potentially refinance to a fixed-rate FHA loan to incorporate balance on your own monthly premiums.

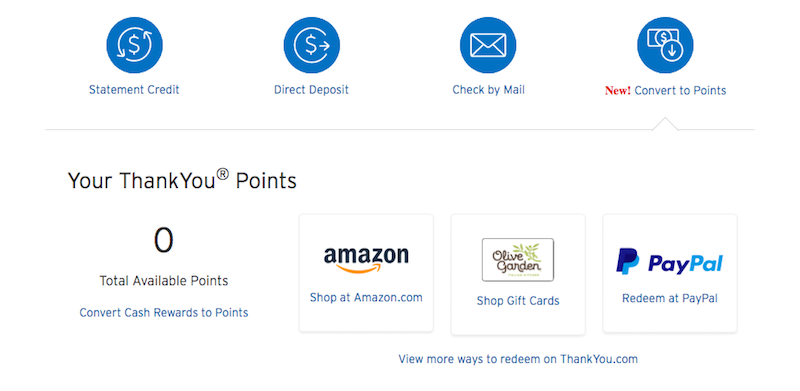

Cash-Out Refinance: FHA even offers cash-aside refinance possibilities, enabling you to make use of your house security. This might be useful for and then make renovations, paying large-attention personal debt, or layer significant costs, such as for example studies or scientific expenses.

Streamline Refinance: The FHA Streamline Refinance program are a simplified techniques built to enable it to be more comfortable for established FHA borrowers to help you re-finance the funds. It requires faster documents and will continually be through with minimal credit and you may appraisal standards, it is therefore a convenient choice for those looking to lower its rates of interest or monthly premiums.

Debt consolidating: When you have large-interest debts, such as for instance mastercard balance or signature loans, you can use an FHA bucks-away refinance so you can consolidate these types of costs for the just one, lower-interest home loan, potentially helping you save currency.

Financial Insurance premium Cures: Dependent on when you initially gotten the FHA loan, the borrowed funds insurance premiums (MIP) you have to pay could be greater than the present day prices. Refinancing your own FHA mortgage could possibly get allow you to reduce your MIP costs.

Home improvement: FHA has the apply for payday loan Marvel benefit of 203(k) recovery financing that can be used to finance home improvements whenever your refinance. It is for example beneficial when you need to get an excellent fixer-top making called for fixes or enhancements.