Exploring the Impact on Family Security

When you seek bankruptcy relief, your home security plays an enormous character in what happens next. Family collateral ‘s the difference in exactly what your house is worth as well as how far you borrowed in it; it amount make a difference if you keep or lose your property.

Defining Home Security and Useful Focus

Household equity means the new percentage of your property you in reality own, computed by using the current market value of your property and you may subtracting people financial or loan number you will still are obligated to pay.

Such as for instance, in case the house is valued from the $300,000 and also you are obligated to pay $two hundred,000 on your mortgage, your property security is $100,000. So it figure can increase as you reduce your own financial obligations or if perhaps the worth of your property rises on account of field transform.

Beneficial need for a house setting which have a monetary stake during the they without being the brand new court owner with the checklist. It refers to the the amount of your right to work for on property they’ve invested money for the – for-instance, owing to mortgage payments.

This concept is extremely important to possess people because it translates to how much of the hard-earned money have effectively repaid the living space.

Methods to Stop House Sales

Supposed bankrupt does not mean you have got to eliminate their family. There are ways to keep household protected from being sold regarding. Listed below are some tips:

- Find out if there is no collateral home. Whether your domestic isn’t really value over you borrowed from inside it, selling may possibly not takes place in first 36 months immediately following you’ve got announced bankrupt.

- Communicate with a personal bankruptcy attorney about reaffirming their home loan. This contract between both you and the lending company enables you to continue and make payments and keep possession of your home.

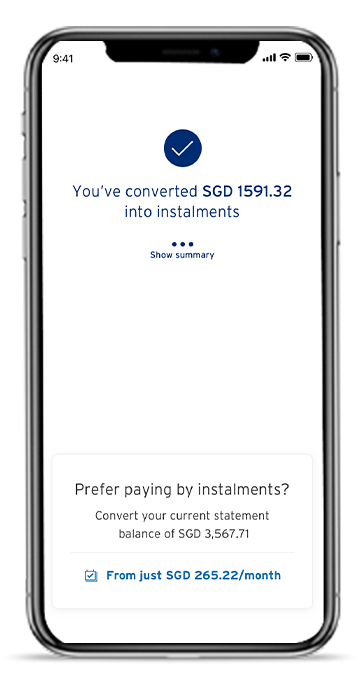

- Customize the loan terms together with your specialist home loan company. Possibly mortgage lenders often to change rates, loan duration, or dominant due and work out payments alot more in check.

- Declare Part 13 case of bankruptcy rather than Chapter 7 whenever possible. Section 13 enables you to create a cost package and you can possibly maintain your possessions.

- Mention losses mitigation alternatives for example forbearance or modification before carefully deciding into the their previous case of bankruptcy. Lenders can offer short term relief off money otherwise to alter mortgage requirements.

- Investigate government-recognized software to get home financing recommendations that could be readily available to assist manage mortgage repayments and get away from property foreclosure.

- Envision strategic economic thought which have professionals who see bankruptcy proceeding effects to your casing things, such as for example formal credit advisors otherwise a card source department concentrating when you look at the individual money recovery article-bankruptcy.

Renting Demands to own Broke Someone

Selecting a unique location to rent would be problematic for some one with experienced case of bankruptcy. Landlords have a tendency to look at your credit reports just before it commit to rent you property. A case of bankruptcy number may make all of them value your capability so you can pay-rent timely.

They might contemplate you as the a leading-exposure tenant because your poor credit items demonstrate that you struggled with loans in Applewood bills prior to now, along with circumstances like overlooked mortgage repayments otherwise credit card defaults.

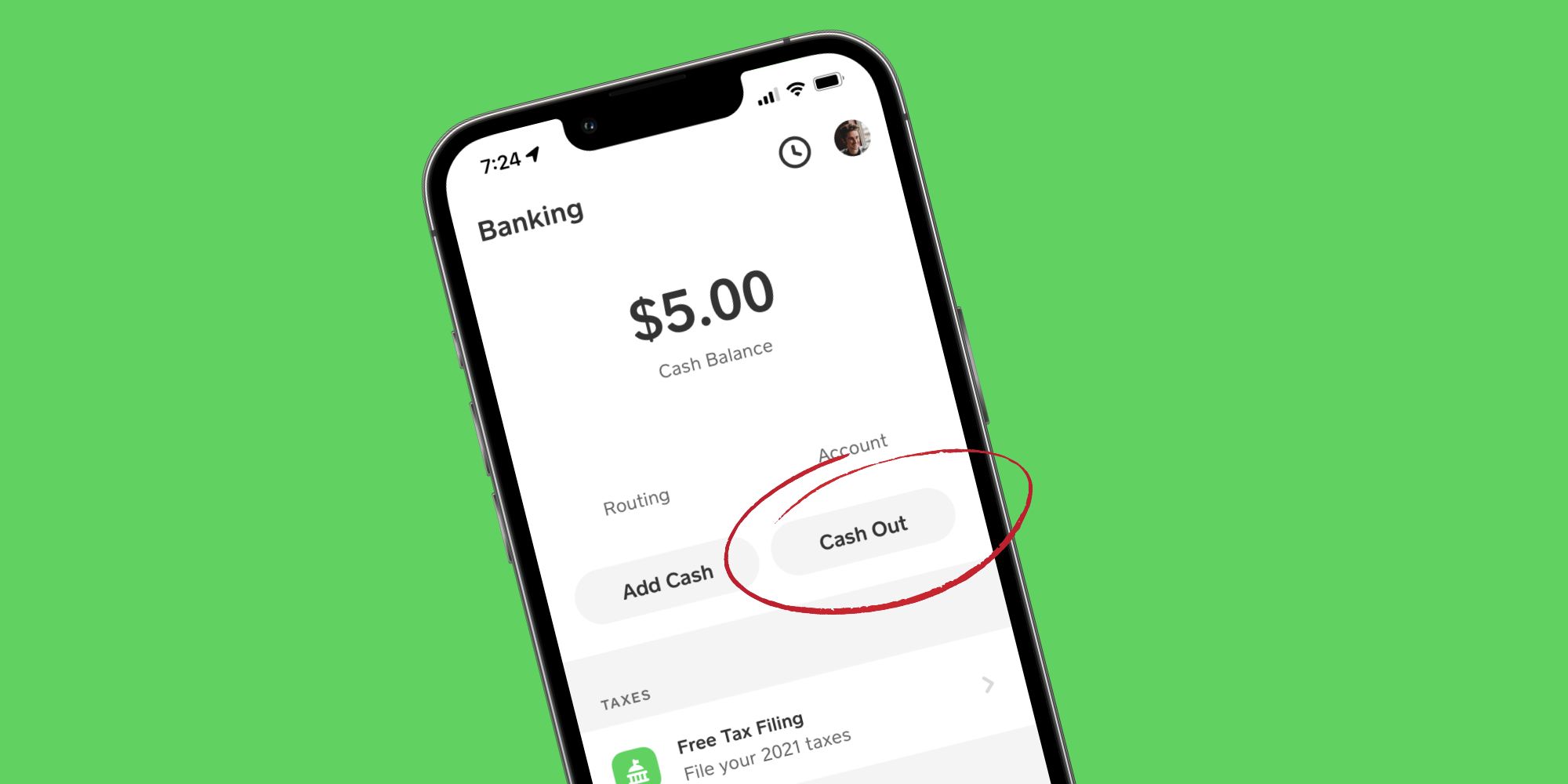

To evolve your odds of leasing once bankruptcy, stand most recent having any payment arrangements and you may communicate openly having possible landlords. Demonstrate to them research that you will be dealing with your bank account really now, such as for example uniform money otherwise a checking account in an excellent condition.

Determine just what resulted in the newest bankruptcy proceeding and you can information the brand new tips you brought to be sure it doesn’t occurs once again. Specific landlords just remember that , group face pressures and tend to be ready to offer clients a spin whenever they get a hold of evidence of economic obligation post-bankruptcy.