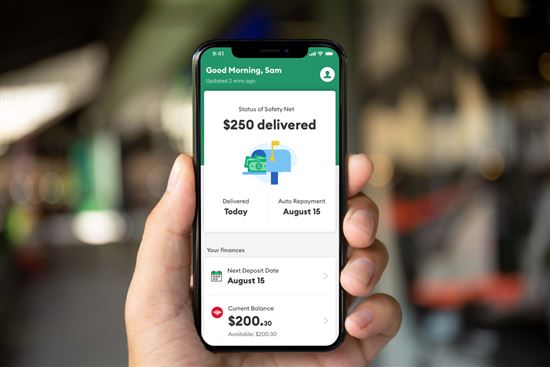

A few lenders will offer financing choice when eventually away from release

- Begin using borrowing again slowly. Getting credit cards immediately following personal bankruptcy should be challenging, however, discover alternatives for your. Don’t use an excessive amount of credit too quickly, however is need quick strategies towards rebuilding your credit rating if you are paying costs timely and beginning a protected mastercard.

- Avoid the same economic errors you to got you to your this example. An individual will be entitled to a home loan, lenders will look during the exactly why you experienced this case and you can attempt to stop should this be browsing recur. This is certainly the real difference for the being qualified for a financial loan otherwise perhaps not.

Bankruptcies is released in the different occuring times with regards to the types of. A part seven bankruptcy is oftentimes discharged regarding four weeks (on average) after you document. However, Chapter thirteen bankruptcies can also be pull towards having lengthier as you was expected to pay the decided installment plan. Usually these bankruptcies was discharged three to five ages adopting the Chapter 13 bankruptcy is actually recorded.

The new better you can personal bankruptcy launch, the greater number of thrilled you will probably feel getting now away from existence at the rear of your. However, this is simply not as soon as to help you forget about your finances. Indeed, the fresh 6 months before their bankruptcy launch might be crucial for your financial future.

Several loan providers will offer you financing selection when someday regarding discharge

- Reevaluate your finances. You need to be keeping track of your credit report and keeping above of your own plan for along the bankruptcy. But six months before discharge, you can even reassess your finances and you can financial obligations. Make sure you are in for success while the launch takes place plus personal bankruptcy payment falls regarding.

- Remain saving. Now could be maybe not the time to cease rescuing your bank account. The more savings you have immediately following their bankruptcy launch, the faster it will be easy to obtain right back in your legs.

- Remark credit file to own precision. Repeatedly, incorrect advice could well be exhibiting in your credit history which could keep you from qualifying otherwise decrease your own closure.

- Opinion predischarge book for much more facts. Look at the Book

Tips to assist your bank account 0-one year after personal bankruptcy launch

Very, you’ve fundamentally got your own personal bankruptcy discharged. It is a big time for anybody. Congratulations! You need to actually have a much better month-to-month earnings and a real sense of accomplishment. You are now potentially entitled to specific mortgage programs, but some lenders tend to have guideline overlays that want a beneficial one- or several-12 months prepared episodes. Old-fashioned and Jumbo finance does not end up being offered unless you are 2-4 many years previous release.

A number of lenders offer financing selection when 1 day out of launch

- Remain a good patterns. Do not let the production of case of bankruptcy allow you to fall back again to crappy financial models. Stay glued to an excellent budget, pay their expense on time, and you may more sluggish reconstruct your credit score.

- Monitor your credit history. Knowing where your credit score really stands is a great means to fix ensure your money are built right up accurately. Of several banking companies otherwise credit card issuers has actually borrowing from the bank overseeing programs getting free. Use them to stay at the top of the borrowing from the bank in this very important date.

- Keep your bankruptcy documents. By a year once a case of bankruptcy discharge, you’re lured to throw out the bankruptcy files. You should never do this. Which records is available in helpful whenever you are prepared to submit an application for a mortgage.

- Do your payday loans Ohio best to remain in a constant domestic and you can occupations. Remaining a constant home and you can work might help show financial institutions that youre a secure wager. Sometimes the unexpected happens and you will house otherwise services must be leftover. not, do your best to store a reliable family and you will business disease toward first couple of ages shortly after your own personal bankruptcy launch.