The united states Agencies out of Farming (USDA) is not just regarding meat monitors, in addition now offers home financing system you to, with respect to the company, aided more than 166,000 parents realize their property ownership ambitions within the 2015 by yourself. The fresh USDA Rural Development Single Loved ones Houses Financing Verify System, or USDA Home loan, also provides numerous rewards you won’t look for together with other mortgage programs. Homebuyers have used that it bodies-supported program since the 1949 to finance home they wouldn’t manage due to conventional paths by using advantageous asset of its extreme positives.

No Down-payment

The biggest, biggest advantageous asset of an effective USDA financial is the zero downpayment specifications. Which preserves homebuyers quite a bit of upfront currency, that may be a obstacle so you can home ownership. Other low down percentage options want restricted amounts that typically begin within 3%, but with USDA finance your take advantage of no-down on that loan equal to the latest appraised property value the brand new household becoming purchased. The ability to receive 100% money is one of cited https://paydayloancolorado.net/arapahoe/ work with this method will bring.

Lenient Candidate Qualification Conditions

Money are available for applicants having low fico scores plus derogatory credit points or restricted borrowing from the bank histories might not hurt the qualification having a mortgage. The fresh new USDA possess versatile borrowing standards compared to other types of loans. Candidates just need a rating regarding 640 getting automated acceptance, but straight down credit scores are occasionally approved which have By hand Underwritten loans, that have more strict standards. The latest USDA and additionally has no need for the absolute minimum a position background on exact same occupations. But not, you are doing you want evidence of secure money toward prior a couple age, particularly if you will be out of work, due to taxation statements.

Lower Monthly Personal Mortgage Insurance policies (PMI)

Whatever the financing program, any loan having less than 20% deposit is required to hold PMI. But not, PMI is much less expensive having a great USDA mortgage and you will is known as make sure charges. These types of charge include an upfront and you can yearly costs. A special advantage of a great USDA home loan is actually these types of charge comprise a minimal PMI speed of every mortgage program. Already, the latest upfront fee was dos% plus the annual payment is actually .50%, nevertheless these are prepared so you’re able to , according to mortgage professionals such as for example Inlanta Financial. A holiday work for ‘s the power to finance their upfront PMI by moving they into your financial support, so you can romantic instead placing anything off.

Competitive Annual percentage rate (APR)

Your zero-advance payment USDA real estate loan does not always mean you can easily pay a good higher Annual percentage rate. These types of financing offer comparable, if not down, costs than you can find with antique fund and other specialized domestic loan apps eg Federal Houses Authority (FHA) loans. Mainly because financing try guaranteed by authorities, lenders give low interest that won’t are very different based on their down-payment or credit history, while they perform that have traditional money. Your take advantage of 15-seasons and you may 29-season fixed rates of interest that competition the newest rates away from most other reduced-focus lower apps.

Reduced Monthly obligations

Because of the no-downpayment, you find yourself that have a high funded harmony that have USDA loans, but it’s usually offset by the down, inexpensive PMI and e, otherwise possibly lower, than other loan solutions, hence specifically advantages household into the strict spending plans.

Numerous Venue Availability

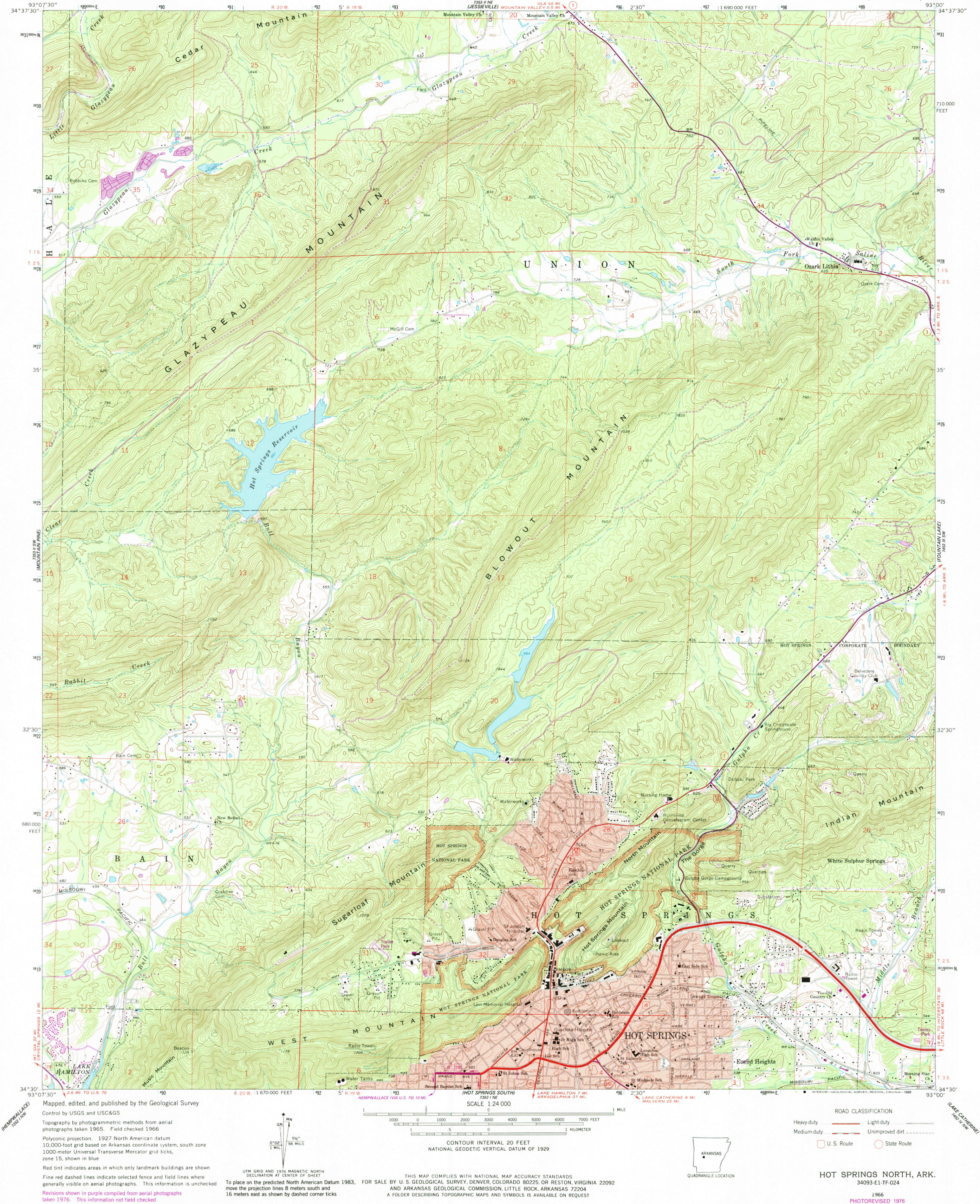

Given that financing is actually specified to own “rural” portion, brand new USDA concept of rural is liberal. Depending on the Financial Declaration, in the 97% out-of result in new U.S. is eligible. Very first guidelines county potential features should be in the elements which have an effective society lower than 10,000, or 20,000 inside the section deemed to have a life threatening shortage of home loan credit getting all the way down/moderate-income family members. Rural categories are not likely to change up to 2020. Of a lot suburbs away from places and you will quick locations slide in these advice. Most areas all over the country has some urban area considered rural and most exterior lying aspects of the greatest towns. Such as for example, Allentown, PA is actually high so you can meet the requirements just like the an eligible outlying urban area, but reduced boroughs during the Lehigh State, such as for instance Coopersburg would. Get a standard notion of licensed cities by asking a great USDA qualification map and be certain that whether particular residential property be considered via your mortgage bank.

Contemplate, the fresh USDA will not financing the mortgage. It couples with accepted lenders who’re ready to build fund that have attractive terms to qualified candidates having a fees guarantee out of this new Rural Innovation Mortgage Make sure Program. Whenever you are there are numerous benefits of a beneficial USDA home loan, you are however subject to all of the eligibility standards of one’s system, therefore not everybody have a tendency to be considered.

If you purchase something or create an account through a link on all of our webpages, we might located compensation. Using this webpages, you consent to our Associate Agreement and concur that their ticks, affairs, and personal suggestions are compiled, registered, and/or stored by the united states and social network and other third-class lovers prior to our Privacy policy.

- Your own Confidentiality Possibilities

- | Associate Contract

- | Advertising Choice

Disclaimer

The means to access and you can/or membership on the any part of this site comprises welcome from our Associate Agreement, (up-to-date 8/1/2024) and acknowledgement of one’s Online privacy policy, and your Privacy Alternatives and you may Legal rights (current 1/1/2025).

2024 Progress Local News LLC. The legal rights kepted (Regarding Us). The information presented on this web site may not be reproduced, marketed, transmitted, cached otherwise utilized, except towards the past created consent regarding Get better Local.