There’s typically a penalty if you withdraw from the account before the term ends. But while you lose some liquidity, term deposit accounts often pay higher yields than demand deposit accounts. Some demand accounts, like checking accounts, allow you to withdraw your funds on demand with no penalties. For instance, some savings accounts limit you to six transactions per month and if you go over, you may have to pay a fee—and even run the risk of having your account closed.

What are the advantages and disadvantages of demand deposit accounts?

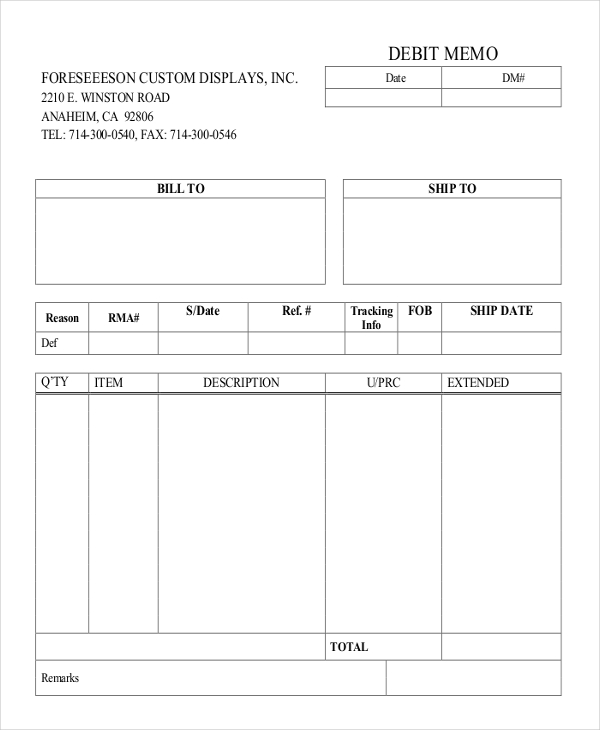

There is some debate about whether other types of accounts, such as a money market account, also qualify as a DDA. NOW accounts require you to give the bank advance notice before making a withdrawal. For example, your bank may require you to request a withdrawal in writing seven days before you plan to make it. Though banks might not always enforce dda debit memo this rule with NOW accounts, it’s important to know that it exists. It could also refer to any transactions, transfers, or online payments that may have taken place from said account, too. You may find a time deposit account, such as a CD, that earns a higher APY, but that’s often in exchange for locking in your funds for a set period of time.

How do demand deposits work?

+ Plus, detailed guides to maximizing the value you get from your new US bank account. Below is the most common question we receive from people looking to better understand DDA debit. If you have further questions you would like answered, don’t hesitate to get in touch with us directly. Kim Porter is a writer and editor who’s been creating personal finance content since 2010. Kim loves to bake and exercise in her free time, and she plans to run a half marathon on each continent. ✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score.

What Happens When a Check Bounces With a DDA Account?

Accounts falling below the minimum value typically are assessed a fee each time the balance drops below the required value. DDA debit refers to “direct debit authorization”, which is an authorized withdrawal from an individual’s bank account by a third party. Not surprisingly, DDA debits are common across a wide range of services, including subscription payments, regular service charges, and more.

What is a demand deposit account (DDA)?

- This accessibility allows for convenient payment options and ensures that your money remains highly liquid.

- Withdrawing your money from such an account before the term has ended typically results in a penalty.

- Most banks offer user-friendly online banking platforms that provide a comprehensive set of tools and features tailored to DDA accounts.

- If the credit balance is considered material, the company most likely will issue a refund to the customer instead of creating a debit memo.

- It is commonly used for everyday expenses, bill payments, and other transactional needs.

There are many different types of checking accounts, including online, interest-bearing, reward, student, and senior checking accounts. In exchange for total accessibility, your demand deposit account may earn very little interest, if any at all. However, your funds are insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000, which can provide some peace of mind.

In an era where competitors are just a click away and customer loyalty is harder than ever to earn, a single fraud incident can have lasting repercussions. When you make a deposit into your DDA, the bank will credit your account with the amount deposited. Conversely, when you make a withdrawal, the bank will deduct the amount from your DDA balance. If a customer pays more than an invoiced amount, intentionally or not, the firm can choose to issue a debit memo to offset the credit and eliminate the positive balance. A debit memo can be created by a firm’s accounting department to offset a credit balance that exists in a customer’s account. The business notifies a customer that the debit memorandum will increase what they owe and change their accounts payable.

Since money market accounts are not primarily designed for money moving in and out frequently, you’ll likely encounter limits on the number of withdrawals you can make in a month. A savings account is a demand deposit account that usually earns a small amount of interest. The annual percentage yield (APY) earned on a savings account is variable, meaning that the bank can raise or lower it at any time. In the high-stakes world of digital finance, DDA fraud is a threat that no institution can afford to ignore.

Depending on the bank and type of account you opened, you should receive a debit or ATM card within a few business days. Many banks got around that rule via negotiable order of withdrawal (NOW) accounts, checking accounts with a temporary holding period on funds, which allowed them to actually pay some interest. • CDs and time deposits are not considered demand deposits as they have set maturity dates and withdrawal fees.

You’ll want to carefully consider how you plan to use the account as well as your financial situation before deciding which type of account will be the right fit for you. Time deposit accounts such as CDs aren’t the right place for an emergency fund, since you’ll likely pay an early withdrawal penalty if you need access to the money before the term expires. A savings account is a good place for your emergency fund, since you can access the money easily when unplanned expenses arise.

In other words, money can be withdrawn from a DDA on demand and as needed. Most banks offer user-friendly online banking platforms that provide a comprehensive set of tools and features tailored to DDA accounts. The platforms often include features such as bill payment services, budgeting tools, account alerts, e-statements, and the ability to request stop payments or order checks online. DDA stands for “Demand Deposit Account”, but what exactly does that mean?