The Backstage Publication. A residential property Trader, Mentor, #step 1 Top-Promoting Author, and you may Tony Prize proceed the link now Champion.

I’ve been investing a property for over 15 years, but at first, like most people, I immediately first started seeking to pay my personal home loan, figuring the brand new less I’d rid of the debt, the better. Following, At long last understood something provides transformed how i believe regarding my personal investment method. It epiphany provides set me personally towards the a course in order to financial independence that’s a whole lot more active and you can effective than just being free off debt.

Plus the extended you can keep one financial obligation, more the potential for your you’ll efficiency. In fact, imagine if We said that just with an inexpensive, well-arranged financial getting 3 decades unlike 15 years, you might earn about three-residence regarding so many cash?

Obligations Isnt A beneficial Monolith

Whenever most people consider obligations, it automatically envision obligations is actually crappy reduce it At the earliest opportunity! In many instances, I agree that the concept of are obligations-free renders done sense in the beginning. Exactly what We have discovered is the fact all of the costs commonly equal.

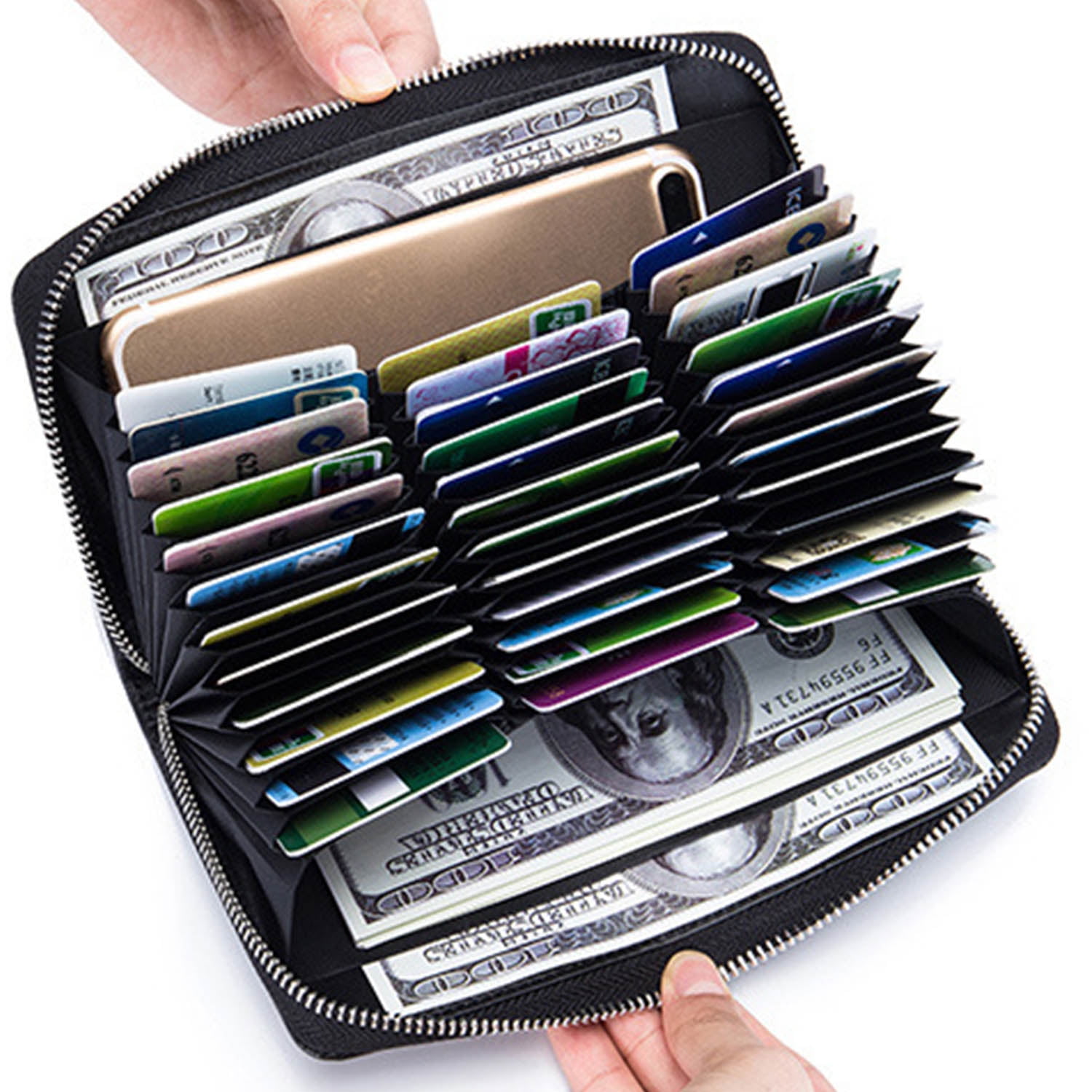

Thankless debt such as for instance credit cards, high priced automotive loans, and personal loans are all examples of just what of a lot name bad loans. Why? They often times carry highest rates of interest or other fees. An effective debt positives you, today or perhaps in tomorrow, and assists your establish a credit history – for example student education loans or a good home loan towards a house. To start with, they frees right up currency to consult with meet your needs correct today.

Paying and obtaining gone bad financial obligation is important. Not one person has to be climbing this new financial steps with that form out-of baggage during the tow. But if you have to really construct your wide range, settling their home loan would not let you wade due to the fact far or as quickly as prudently leveraged possessions have a tendency to. Check out things to ask yourself:

A mortgage Contributes to Guarantee

Need a place to live, so buying a home are a smart investment. Their month-to-month mortgage repayments reduced pay back the debt, which is called building equity. Which is much better than providing it in order to a property manager and you can helping make their equity rather than a.

A mortgage May help Build Inactive Earnings

Accommodations property can produce couch potato money – winnings that you don’t really need to benefit – each month. Plus, your own tenant’s rent will pay on the loans and there might be income tax gurus, too.

Anyway – no. 1 house otherwise rental possessions – either someone like a smaller home loan title, will 15 years in place of 30, but paying the financial obligation from easily may well not help you create wealth smaller. While it can make you then become advisable that you repay the loans quickly, you are lost some crucial lifestyle and you can wide range-strengthening possibilities.

Date Is found on Your own Side

Rising prices reduces your dollar’s to invest in control over big date. With a home loan, youre borrowing playing with today’s cash but purchasing the mortgage straight back with coming cash. The value of people dollars gets smaller annually, nevertheless don’t need to pay more.

Borrowing money now and you may purchasing one same count straight back after, if the dollar’s worth are quicker, might be a sensible method. This can features a more tall impact over 30 years instead of 15 years. Set date (and you will rising prices) in your favor and you will extend your home loan repayments having as much time as you can.

The brand new Secret Out-of Self-confident Bring

The most significant dispute on the side of those who would like to pay the debt easily is actually appeal. Appeal ‘s the amount of the mortgage repayment that goes toward the bank because their profit having providing you the borrowed funds. This new longer the word, the more appeal you’ll pay over the longevity of the newest loan.

The full cost of a beneficial $five hundred,000 mortgage at a great 5% interest rate to have thirty years is actually $966,279 which have monthly obligations off $2,684.

On the deal with of it, no one wants to invest nearly $255,000 within the even more attention across the life of the borrowed funds. But really, if you find yourself that interest improvement is generous, you can find immense pros which come along with it. Their 29-12 months financial keeps far smaller repayments, providing an extra $1,270 in your pocket every month that’ll change your top quality off lifestyle. Better yet, for folks who really want to grow your money, you could place those funds on the another type of investment. Provided you to definitely most other resource provides increased get back than simply the mortgage, might make a profit. This concept is called confident bring.

The idea of self-confident bring is that you was delivering virtue of the difference between the price of the mortgage therefore the come back you can get because of the expenses the cash in other places. For example, a big difference amongst the desire you are using to the a loan (5%) in place of new finances you get using men and women dollars someplace else (8%) manage end in an optimistic bring (3%).

Using self-confident carry, you might indeed be earning money off the bank’s currency. The total amount can be very big along side 30-seasons lifetime of the loan. A great $step 1,270 investment per month, making only 3%, combined month-to-month, over 30 years, grows so you’re able to $745,089. Yes, your understand you to truthfully. Within this scenario, having home financing to possess three decades in the place of 15 years expands your money by the nearly three-quarters regarding a million dollars. The primary let me reveal to expend your bank account to your a chance capable of producing that step 3% carry.

Successful Which have Power

To-be obvious, I am not stating that someone is to alive away from the function. You ought not gain financial obligation – naturally an awful idea. Control is a huge multiplier – it magnifies both wins and losings instead of prejudice. But do not forget in order to maintain financial obligation so you can raise forget the possible.

It’s not necessary to become personal debt-free to feel the monetary liberty which comes off additional money in your pocket per month, otherwise broadening your own riches as a result of self-confident bring. Explore control to increase your own productivity, just do thus responsibly. Which change from inside the mindset away from shunning all of the debt into an excellent even more nuanced strategy can definitely accelerate their production.